This is how the United States Federal Reserve (FED) came to be:

“Our taxes are used to pay the interest on the National Debt, which is money our government owes to the Federal Reserve; which is not Federal. The stockholders of the Federal Reserve are banks and investment companies that are all part of the cabal that brought the Federal Reserve into existence in 1913 and thus necessitated the creation of the federal income tax a year later. Very little of our tax money goes toward running the country. The money that is sent for foreign aid is money borrowed from the Federal Reserve at 5 percent annual interest. The only way out is for Congress to abolish the Federal Reserve and establish our own currency; not that of the Federal Reserve. That is why Abraham Lincoln and John F. Kennedy were killed. They knew the dangers of a central bank and therefore wanted to print our own currency. Five Presidents in the nineteenth century were assassinated for the same reason.”

1. The enormity of this topic, especially with regard to the legal right to create money, requires hundreds of pages to cover properly. This will provide only a short introduction. To fully understand the power derived from creating money, we highly recommend further research into the FED.

2. For a good beginner’s guide (about 200 pages) read “Dishonest Money: Financing the Road to Ruin”, by Joseph Plummer. For a much more thorough account (about 600 pages), we highly recommend “The Creature from Jekyll Island”, by G. Edward Griffin.

3. “We are afraid the ordinary citizen will not like to be told that the banks can, and do, create money…and they who control the credit of the nation direct the policy of Governments and hold in the hollow of their hands the destiny of the people.”

4. That statement from Reginald McKenna, British Chancellor of the Exchequeris (treasury) is about as straightforward as it gets, and it comes from a man who had intimate knowledge of the topic.

5. He worked at the highest levels within the system and is stating, unequivocally, exactly how it is. Those who create money and control the credit of the nation “direct the policy of governments and hold in the hollow of their hands the destiny of the people.”

6. So why is it, if creating money and controlling credit confer so much power, that so few people understand either of these topics? Shouldn’t we all be taught the dangers of such power? Is it any surprise that we aren’t?

7. John Kenneth Galbraith, Influential economist and professor of economics at Harvard, explained “The study of money above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it. The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent.”

8. The practice of deceiving governments and people about money continues to this day, because it’s the only way for the ruling elite to maintain its current power.

9. Rest assured, if the vast majority of people don’t understand central banks or how they operate, it is because they weren’t meant to. Few realize that during the last few centuries, while the peoples of the world gradually were winning their political freedom from monarchies.

10. The major banking families of the world were nullifying the trend toward representative government by setting up new dynasties of political control, but behind the scenes, in the form of international financial combines.

11. These banking dynasties had learned that all governments, whether they be monarchies or democracies, must borrow money in times of emergency & that by providing private funds, with strings attached, of course; gradually they could bring both kings/political leaders under their control.

12. Their key to success has been to control and manipulate the money system of a nation, while letting it appear to be controlled by the government. The net effect is to create money out of nothing, lend it to the government and collect interest on it; a rather profitable transaction, to say the least.

13. People should be more familiar with the identities of these clever banking dynasties. They include such names as Barring, Hambros, Lazard, Erlangcr, Warburg, Schroder, Selingman, Speyers, Mirabaud, Mallet, Fould, Lehman, and above all, Rothschild, Rockefeller, and Morgan.

14. It should be noted that, while the Rothschilds and other Jewish families cooperated together in these ventures, this was by no means a Jewish monopoly as some have alleged.

15. Men of finance of many nationalities and many religious and non-religious backgrounds collaborated together to create this super-structure of hidden power. Its essence was not race, nor religion, nor nationality. It was simply a passion for control over other human beings.

16. It all started with a man called William Paterson who was a Scottish trader and banker. Paterson made his fortune with foreign trade (primarily with the West Indies) at the Merchant Taylors’ Company.

17. In 1694, he founded the Bank of England to act as the English government’s banker. England had just suffered through 50 years of war. Financially exhausted, the government needed loans to fund their political activities.

18. Paterson proposed a loan of £1.2 million (approximately $35.8 Billion in today’s money) to the English government. In return, his bank would receive privileges, which included the issuing of money notes. The English government soon endorsed this idea and the very first private central bank was born.

19. Through his privately owned bank, the central bank of England, William Paterson was able to issue and loan money to the English government out of thin air with interest, and his bank has been doing so ever since.

20. Fast forward to the 20th century. After two failed attempts, another group of bankers wanted to establish a private central bank in the United States of America.

21. It was December of 1910 and Senator by the name of Nelson Aldrich boarded a private rail car with six other men parked at a New Jersey train station. The destination? Jekyll Island off the coast of Georgia. (At that time, this Island was an exclusive retreat of the wealthy elite).

22. These six men were agents from the world’s three greatest banking houses: those of John D. Rockefeller, J. P. Morgan, and the Rothschilds. Together, they represented an estimated 25 percent of the World’s entire wealth.

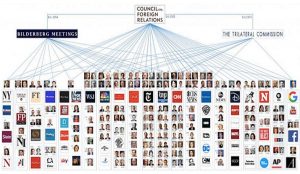

23. Acting for the Rockefellers were Senator Aldrich and Frank Vanderlip. Representing the Morgan interests were: Benjamin Strong, Henry Davison, and Charles Norton. It should be noted that these three bankers went on to become Founding Members of the Council on Foreign Relations (CFR).

24. The dangerous CFR and how this subversive group has been working to destroy U.S. sovereignty since 1921.

25. But the most important figure, who actually ran the secret meeting, was Rothschilds’ agent, Paul Warburg (also a founding CFR member).

26. What came out of that meeting you might ask? The meeting went for nine days, and from that, these international bankers wrote the legislation that would grant to them a private franchise over this nation’s money system.

27. Of course, this group had to conceal the fact that it would be writing the legislation itself, and this presented some problems. The lengths it went to in order to hide its role reads like a scene out of a mystery novel.

28. Unfortunately, the Jekyll Island story didn’t leak until 1916, years after the damage had already been done. And even after it was exposed, “educators, commentators, and historians” continued to deny that the meeting ever took place.

29. Anyone who pointed out the nefarious origins and authors of the Federal Reserve Act was smeared and dismissed as a conspiracy theorist. Fortunately, the truth finally did come out, and the conspiracy theorists were vindicated.

30. Perhaps the most definitive admission came from Frank Vanderlip, President of the most powerful New York bank at the time (National City Bank, now Citibank) whom later went on to reveal his role in the writing of the bill that created the FED.

31. Despite this admission over 75 years ago, despite other participants and their biographers who have admitted the same, despite the fact that Federal Reserve Chairman (Ben Bernanke) returned to Jekyll Island in 2010 to commemorate the FED’s founding 100 years earlier.

32. Still the vast majority of people have never heard of the trip to Jekyll Island and have no idea that “international bankers” created the system that was supposed to protect them from international bankers.

33. The Federal Reserve’s origination at the Jekyll Island meeting is well-established. Today Jekyll Island is open to the public. You can visit the Jekyll Island Club Hotel, and sit in its “Federal Reserve Room” where the Fed was birthed.

34. Using government as its instrument, these criminals designed America’s central bank, crafting the name “Federal Reserve System” to deceive Americans. While “Federal” implied public control, it is in fact owned by private shareholders.

35. “Reserve” suggested it would hold reserves to protect banks, but it has no hard assets; only instruments of debt. “System” implied its power would be to diffuse (through regional Federal Reserve banks) whereas actual power would be centralized in the Board & the New York FED.

36. Sneaking the unconstitutional Federal Reserve System scheme into law to sell this scheme to the voters, these bankers created the propaganda line that the proposed banking law some how would work against the monopolies.

37. The bankers initially drafted the Federal Reserve as the “Aldrich Bill”, but when it came to Congress, they recognized Senator Alfred Aldrich’s name, became suspicious, and decided against passing the bill.

38. A newly packaged Glass-Owen Federal Reserve Act, which mirrored Aldrich’s version in “all essential provisions” was then put forward by Democrats as being radically different; a bill written by selfless public servants to protect the citizenry from selfish out-of-control bankers.

39. Politicians took up the cry “Banking Reform” and “Down with Wall Street”. And then, to make it look convincing, the very same people who helped author the legislation on Jekyll Island began speaking out publicly against it.

40. As the Federal Reserve Act moved closer to its birth, both Aldrich & Vanderlip threw themselves into a great public display of opposition. No opportunity was overlooked to make a statement to the press (or anyone else of public prominence) expressing their eternal animosity to it.

41. Since Aldrich was recognized as associated with the Morgan interests and Vanderlip was President of Rockefeller’s National City Bank, the public was skillfully led to believe that the “big bankers” were mortally afraid of the proposed Federal Reserve Act.

42. The Nation was the only prominent news publication to point out that every one of the horrors described by Aldrich & Vanderlip could have been equally ascribed to the original Aldrich Bill. But this lone voice was easily drowned out by the great cacophony of deception and propaganda.

43. And as Vanderlip, Aldrich, and other “big-business Republicans” continued to attack the “new” legislation, more and more well-meaning Americans fell for the ruse.

44. In the waning hours of December 23, 1913 when most of Congress had already left for the holidays the Federal Reserve Act finally was passed into law. Something known as the Federal Reserve System came into being and with it total control of the nation’s money fell into private hands.

45. President Wilson named Paul Warburg (CFR member), vice chairman of the Federal Reserve Board (a position from which national interest rates would be set). Benjamin Strong (CFR member), was appointed to run the New York FED, the system’s nucleus.

46. The very men who had secretly planned the bank now controlled it. The “foxes” are/were in charge of the “hen house”.

47. Among the privileges that Woodrow Wilson received for the role he played in initiating the Federal Reserve, they printed his face on the largest U.S. dollar note ever issued, the 100,000 dollar bill.

48. They fashioned these money notes from December 1934 to January 1935 and used them for transactions between Federal Reserve Banks, not for circulation among the general public.

49. Quick sidenote on Senator Nelson Aldrich: You may not have heard of ‘Aldrich’ but you’ve probably heard of billionaire New York governor Nelson Rockefeller (also a member of the CFR) and one of America’s richest men and Vice President to Gerald Ford (whom also a CFR member).

50. His full name: Nelson Aldrich Rockefeller, named for his grandfather, Nelson Aldrich. Aldrich’s daughter married John D. Rockefeller, Jr., and his son Winthrop (also a founding member of the CFR), served as chairman of the Rockefellers’ Chase National Bank.

51. When Nelson Aldrich spoke on Capitol Hill, insiders knew he was acting for the Rockefellers and their allies in high finance.

52. In addition to Nelson Aldrich’s “Public service” of helping create a central bank in the U.S., it should be noted that he authored and led the conception of the 16th Amendment to the Constitution that authorized the imposition of the Federal Income Tax on American citizens.

53. This overachieving traitor accomplished this in the very same year he co-directed the conception of the FED.

54. Though now an accepted way of life, income tax was not always around. The original U.S. Constitution excluded it; in 1895 the Supreme Court ruled it would be unconstitutional.

55. Therefore, the only way these bankers could establish income tax was by legalizing it through a Constitutional Amendment.

56. Why did Americans accept income tax? Because it was originally only one percent of a person’s income, for salaries under $20,000 (the equivalent of about $500,000 in today’s dollars).

57. Senator Aldrich and other supporters of the tax issued assurances it would never go up. So patriotic Americans said: “If Uncle Sam needs one percent of my salary, and I can always keep the rest, it is Okay by me.”

58. But you know what happened. Congress later dolefully informed Americans it needed to raise taxes a smidgen. A few smidgens later and, depending on bracket, we are losing 15, 25, 28, or 33 percent of our income to federal tax.

59. It is said that if you want to boil a frog, you can’t just toss him in theboiling water. Instead, you put him in lukewarm water, and gradually turn up the heat.

60. That way, the frog never realizes he has been boiled. This, in effect, is what these traitors did to Americans, knowing that once we became accustomed to taxes, the amounts could incrementally be turned up to “boil”. It was a long-range plan.

61. It would logically follow that these rich bankers would never have wanted an income tax. After all, it “soaks the rich”; the wealthier you are, the more taxes you pay.

62. It is true that income tax is graduated. If an American today earns $100,000 or $200,000 per year, he or she usually owes lots of tax. But not the super-rich. The conspirators had no intention of paying substantial income tax.

63. How did these wealthy banking families escape taxes? The means were numerous, but a major one was placing their assets in tax-free foundations, and using their grants to advance their globalist agenda.

64. In summary, this is what happened. In 1913, these criminals created the Federal Reserve, which not only gave them control over interest rates and thus the stock market, but empowered them to create trillions of dollars from nothing, which they would then loan back to America.

65. Also in 1913, the criminals ended tariffs and installed income tax, enabling them to exact repayment on these interest-bearing loans to the government. Ever since, America has been immersed in skyrocketing debt, now said; officially, to exceed $22 trillion.

66. Incidentally, Washington politicians love this system. By letting the FED finance their expenditures with money made from nothing, politicians know they can spend without raising taxes.

67. When the FED produces more currency, making prices rise, who do we blame? Not the FED. Not politicians. Instead, we blame the local business or retail store.

68. “Why are you guys jacking up your prices again?” Or we blame the candy company for making a smaller chocolate bar, or the cereal company for putting less corn flakes in the box.

69. But these businesses are simply trying to cope with the same dilemma as We The People: inflation. The problem is not that prices are going up, the problem is everytime the FED creates money from nothing it increases the amount of money in America, thereby decreasing money’s value.

70. For the banking elite, the system meant endless profits, but for the rest of us, it is a hidden tax. And it is more unfair than conventional taxes, which are scaled by income. Inflation affects all equally, making no exceptions for the needy.

71. In America today, many young couples work hard. Commonly, both spouses hold jobs and can barely pay the rent.

72. When great grandpa came to America, income tax didn’t exist. Today’s average workers lose up to 50% of their pay to taxes: fed income tax, state income tax, SSN tax, real estate tax, sales tax, excise tax, utilities tax, et al.

73. If half a family’s wages go to taxes, won’t it need 2 jobs to maintain the same standard of living? Furthermore, great grandpa had a stable dollar; it didn’t plummet in value every year like now. (The American colonists went to war with Britain when tax levels reached only 21%.)

74. That is why, following 250 years of stable prices, we have had punishing inflation since the FED’s birth in 1913. Every effect has a cause.

75. The price levels from 1774 – 2012. Note there was no net inflation for the first 113 years (only inflationary blips during wartime that returned to its normal value). Then, in 1913, with the creation of the FED, our money began to rapidly and permanently lose its value.

76. It is particularly noteworthy that in Communist Manifesto, Karl Marx laid down 10 steps he proclaimed necessary to establish a communist totalitarian state. Step 2 was: “A heavy progressive or graduated income tax.”

77. Step 5 was: “Centralization of credit in the hands of the State, by means of a national bank with state capital and an exclusive monopoly.”

78. Therefore in 1913, the United States enacted two of Marx’s conditions for a communist dictatorship. Income tax and central banks have nothing to do with free enterprise or the American way of life.

79. The original U.S. Constitution excluded an income tax, which the Founding Fathers opposed. Concerning money, the U.S. Constitution declares (Article 1, Section 8): “Congress shall have the power to coin money and regulate the value thereof.”

80. The Federal Reserve Act illegally and unconstitutionally transferred this authority from our elected representatives to private bankers.

81. As President Thomas Jefferson warned us in 1809: “I believe that banking institutions are more dangerous to our liberties than standing armies; if the American people ever allow private banks to control the issue of their currency.

82. Representative Louis McFadden, Chairman of the House Banking and Currency Committee, explained about the FED in 1932: “We have in this country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks; first decieve by inflation, then by deflation, the banks and corporations that will grow up around “the banks” will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered.”

83. U.S. Senator George Malone, speaking before Congress about the FED explained in 1962:

84. Some people think the Federal Reserve Banks are United States Government institutions. They are not Government institutions. They are private credit monopolies which prey upon the people of the United States for the benefit of themselves and their foreign customers.

85. They are the agents of the foreign central banks. Every effort has been made to conceal its powers but the truth is the FED has usurped the government. It controls everything here (in Congress) and controls all our foreign relations. It makes and breaks governments at will.

86. Congressman James Traficant, addressing the House about the FED: “Their lust is for power & control. Since the inception of central banking, they have controlled the fates of nations. The FED is a sovereign power structure separate and distinct from the federal U.S. government.

87. “We believe that if the people of this nation fully understood what Congress has done to them over the last 49 years, they would move on Washington; they would not wait for an election. It adds up to a preconceived plan to destroy the economic and social independence of the United States.”

88. Henry Ford, founder of the Ford Motor Company, said: “It is well enough that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

89. This has been going on for over 100 years without the “informed knowledge” of the American people, without a voice protesting loud enough. Now it is easy to grasp why America is fundamentally bankrupt. Our children will inherit this unpayable debt and the tyranny to enforce paying it.

90. Unwittingly, America has returned to its pre-American Revolution, feudal roots. Once again, We The People are the tenants and sharecroppers renting our own property from a Sovereign in the guise of the Federal Reserve Bank. We the people have exchanged one master for another.

91. Senator Barry Goldwater posed the following question: “Does it not seem strange to you that these men just happened to be CFR (Council on Foreign Relations) and just happened to be on the Board of Governors of the Federal Reserve, that absolutely controls the money and interest.

92. Make no mistake. As of 1941, the financial powers behind the FED and the CFR have already secretly achieved complete dominance over America. As described by U.S. Senator George Norris in a congressional speech on November 30, 1941 rates of this great country. “A privately-owned organization which has absolutely nothing to do with the United States of America.” The origins of this CFR organization has been whittling away at our national sovereignty for over a century.

93. It is important to understand that these same criminals described by U.S. Senator George Norris were also behind the hijacking of the media and free press in our country in 1915.

94. “when the business of the country is controlled by men who can be named on the fingers of one hand, because those men control the money of the Nation, and that control is growing at a rapid rate.”

95. “They control practically every public utility, they control literally thousands of corporations, they control all of the large insurance companies. We are gradually reaching a time, if we have not already reached that point.”

96. “J. P. Morgan, with the assistance and cooperation of a few of the interlocking corporations which reach all over the United States in their influence, controls every railroad in the United States.”

97. Let us look briefly at how the Federal Reserve criminals intentionally caused the Great Crash of 1929.

98. Most people are familiar with Charles Lindbergh, Jr., “Lucky Lindy”, who made the first solo nonstop transatlantic flight. Fewer people know that his father, Charles, Sr., was a distinguished member of congress. In December 1913 he declared on the floor of the House:

99. “Several strategies were used to precipitate the 1929 crash. One was interest rates. The FED increased the discount rate from 3.5% in January of that year to 6% in late August.”

100. “Another tactic was calling loans used to purchase stock. In 1929, one could heavily buy stocks ‘on margin’ (with 90% borrowed money). But many of these were ’24-hour call loans’, meaning the loan could be called at any time, requiring immediate repayment.”

101. “For most investors, the only way to repay was to sell the stock. Simultaneously calling huge numbers of these loans would, of course, cave in the stock market.”

102. The combination of higher interest rates, called loans and short-selling caused a plunge that snowballed into a complete panic.

103. Were stocks unloaded on the people at high prices, then bought back at low prices after a panic? Yes. The “day of reckoning” Lindbergh predicted came with “Black Thursday” and the Great Crash of 1929.

104. Afterwards, the international banking criminals moved back into the market, exactly as Congressman Lindbergh had predicted. They bought up stocks that once sold for $10 per share at $1 per share, widening their ownership of corporate America.

105. The October 1929 stock market collapse wiped out millions of small investors; but not the conspirators of the FED. These banking criminals and other top insiders had exited the market.

106. Friendly biographers attribute this to their fiscal “Brilliance”. But it was actually fiscal foreknowledge, of the Federal Reserve policy they were now controlling.

107. Congressman McFadden said of the crash: “It was not accidental. It was a carefully contrived occurrence. The international bankers sought to bring about a condition of despair here so that they might emerge as rulers of us all.”

108. Senator Robert L. Owen, co-sponsor of the Federal Reserve Act (the Glass- Owen Bill), testified before the House Committee on Banking and Currency in 1938:

109. Further verification that even this was a calculated event, is found in the writings of William Jennings Bryan, who was U.S. Secretary of State under Woodrow Wilson, who described this criminal event by the FED.

110. Milton Friedman, Nobel Prize winning economist, confirmed: “The Federal Reserve definitely caused the Great Depression by contracting Americas’ money supply by one third between 1929 and 1933.”