Invest for Success

Last modified: November 22, 2023“Hope is not a strategy. Manage risk. Be proactive. Make smart decisions.”

“Be wary of the man who urges an action in which he himself incurs no risk.”

“Take calculated, smart risks. That is quite different from being rash.”

“Rumors are created by losers, spread by fools, and accepted by idiots.”

“Educate yourself and live a longer less stressful life.”

“You can’t build a reputation or success on what you are going to do. You must Act. You must Do.”

“When protecting and preserving your wealth, you should think a lot more about risk managing the ‘downside’, rather than chasing the ‘upside’.”

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”– Sir John Templeton

“If you want to have a better performance than the crowd, you must do things differently from the crowd.”– Sir John Templeton

“Invest at the point of maximum pessimism.”– Sir John Templeton

“The four most dangerous words in investing are: ‘This time it’s different’.”– Sir John Templeton

“The individual investor should act consistently as an investor and not as a speculator. This means that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.”– Benjamin Graham

“The investor’s chief problem — even his worst enemy — is likely to be himself.”– Benjamin Graham

“Wall Street people learn nothing and forget everything.”– Benjamin Graham

“I will tell you how to become rich. Be fearful when others are greedy. Be greedy when others are fearful.”–Warren Buffett

“I buy when other people are selling.”–J. Paul Getty

“The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine.”– Warren Buffett

“It takes twenty years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”– Warren Buffett

“When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”– Warren Buffett

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”– Warren Buffett

“High returns do not come from investing at low valuations. High returns come from investing in good companies.”

+——————————————————————————————————————————-+

Growth, Inflation, Policy (GIP) Model

“QUAD 1 Goldilocks: Growth accelerating, Inflation slowing. Invest in: Technology, Consumer Discretionary, Industrials, Materials, Commodities, Copper, Silver, High Beta, Momentum, Cyclicals, and Mid Caps.”

“QUAD 2 Reflation: Growth accelerating, Inflation accelerating. Invest in: Technology, Consumer Discretionary, Industrials, Energy, Crude Oil, Commodities, Momentum, Growth, Small Caps, High Beta.”

“QUAD 3 Stagflation: Growth slowing, Inflation accelerating. Invest in: Utilities, Technology, Energy, REITS, Crude Oil, Secular Growers, Low Beta, Quality, and Growth.”

“QUAD 4 Deflation: Growth slowing, Inflation slowing. Invest in: Consumer Staples, Healthcare, REITS, Utilities, Gold, Low Beta, Quality, Value, Dividend Yield, and Defensives.”

+——————————————————————————————————————————-+

“All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.”– Peter Lynch

“The best stock to buy is the one you already own.”– Peter Lynch

“I think you have to learn that there’s a company behind every stock, and that there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies.”– Peter Lynch

“Investors should always keep in mind that the most important metric is not the returns achieved but the returns weighed against the risks incurred. Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.”– Seth Klarman

“Avoiding where others go wrong is an important step in achieving investment success.”–Seth Klarman

“Individual and institutional investors alike frequently demonstrate an inability to make long-term investment decisions based on business fundamentals.”–Seth Klarman

“Investment success cannot be captured in a mathematical equation or a computer program.”–Seth Klarman

“The focus of most investors differs from that of value investors. Most investors are primarily oriented toward return, how much they can make and pay little attention to risk, how much they can lose.”–Seth Klarman

“Once you adopt a value-investment strategy, any other investment behavior starts to seem like gambling.”–Seth Klarman

“Investors buy securities that appear to offer attractive return for the risk incurred and sell when the return no longer justifies the risk.”–Seth Klarman

“Investors believe that over the long run security prices tend to reflect fundamental developments involving the underlying businesses.”–Seth Klarman

“Speculators are obsessed with predicting-guessing-the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron’s, every week in dozens of market newsletters, and whenever business people get together.”–Seth Klarman

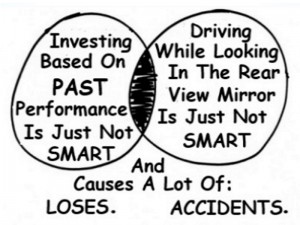

“In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a speculative undertaking.”–Seth Klarman

“Successful investors tend to be unemotional, allowing the greed and fear of others to play into their hands. By having confidence in their own analysis and judgment, they respond to market forces not with blind emotion but with calculated reason. Successful investors, for example, demonstrate caution in frothy markets and steadfast conviction in panicky ones. Indeed, the very way an investor views the market and its price fluctuations is a key factor in his or her ultimate investment success or failure.”–Seth Klarman

“You cannot ignore the market – ignoring a source of investment opportunities would obviously be a mistake – but you must think for yourself and not allow the market to direct you.”–Seth Klarman

“Supply and demand imbalances can result from year-end tax selling, an institutional stampede out of a stock that just reported disappointing earnings, or an unpleasant rumor.”–Seth Klarman

“Investors will frequently not know why security prices fluctuate.”–Seth Klarman

“When a Wall Street analyst or broker expresses optimism, investors must take it with a grain of salt.”–Seth Klarman

“Wall Street research is strongly oriented toward buy rather than sell recommendations. There is more business to be done by issuing an optimistic research report than by writing a pessimistic one.”–Seth Klarman

“The problem is that with so much attention being paid to the upside, it is easy to lose sight of the risk.”–Seth Klarman

“Overvaluation is not always apparent to investors, analysts, or managements. Since security prices reflect investors’ perception of reality and not necessarily reality itself, overvaluation may persist for a long time.”–Seth Klarman

“Financial market innovations are good for Wall St but bad for clients.”–Seth Klarman

“The value of a company selling a trendy product, such as television shopping, depends on the profitability of the product, the product lifecycle, competitive barriers, and the ability of the company to replicate its current success.”–Seth Klarman

“There will always be cycles of investment fashion and just as surely investors who are susceptible to them.”–Seth Klarman

“In the 40 years 1950-1990, the share of institutional ownership in all publicly traded US equity securities increased from 8% to 45%.”–Seth Klarman

“Today institutional investors dominate the financial markets accounting for roughly 75% of stock exchange trading volume. All investors are affected by what the institutions do, owning to the impact of their enormous financial clout on security prices. Understanding their behavior is helpful in understanding why certain securities are overvalued while others are bargain priced and may enable investors to identify areas of potential opportunity.”–Seth Klarman

“It is worth noting that few institutional money managers invest their own money along with their clients’ funds. The failure to do so frees these managers to single-mindedly pursue their firms’, rather than their clients’ best interests.”–Seth Klarman

“An investor’s time is required both to monitor current holdings and to investigate potential new investments.”–Seth Klarman

“The return per dollar invested declines as total assets increase. The principal reason is that good investment ideas are in short supply.”–Seth Klarman

“Being fully invested at all times will at best generate mediocre returns; at worst they entail both a high opportunity cost – foregoing the next good opportunity to invest – and the risk of appreciable loss.”–Seth Klarman

“Neither the stock nor the bond market is infinitely deep. Vast sums cannot be instantaneously switched from one area to the other without moving the markets and incurring considerable transaction costs as well.”–Seth Klarman

“By contrast value investing is predicated on the belief that the financial markets are not efficient. Value investors believe that stock prices depart from underlying value and that investors can achieve above-market returns by buying undervalued securities. To value investors the concept of indexing is at best silly and at worst quite hazardous. I believe that over time value investors will outperform the market and that choosing to match it is both lazy and short sighted.”–Seth Klarman

“Investors must try to understand the institutional investment mentality for two reasons. First institutions dominate financial market trading; investors who are ignorant of institutional behavior are likely to be periodically trampled. Second, ample investment opportunities may exist in the securities that are excluded from consideration by most institutional investors. Picking through the crumbs left by the investment elephants can be rewarding. Investing without understanding the behavior of institutional investors is like driving in a foreign land without a map. You may eventually get where you are going, but the trip will certainly take longer, and you risk getting lost along the way.”–Seth Klarman

“Value investing is predicated on the efficient market hypothesis being wrong.”–Seth Klarman

“I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather ‘Don’t lose money’ means that over several years an investment portfolio should not be exposed to appreciable loss of principal.”–Seth Klarman

“The avoidance of loss is the surest way to ensure a profitable outcome.”–Seth Klarman

“The actual risk of a particular investment cannot be determined from historical data. It depends on the price paid.”–Seth Klarman

“Loss avoidance must be the cornerstone of your investment philosophy.”–Seth Klarman

“Value investing is the discipline of buying shares at a significant discount from their current underlying values and holding them until more of their value is realized. The element of a bargain is the key to the process.”–Seth Klarman

“Value investing combined the conservative analysis of underlying value with the requisite discipline and patience to buy only when a sufficient discount from that value is available.”–Seth Klarman

“Sometimes a value investor will review in depth a great many potential investments without finding a single one that is sufficiently attractive. Such persistence is necessary, however, since value is often well hidden.”–Seth Klarman

“The disciplined pursuit of bargains makes value investing very much a risk-averse approach.”–Seth Klarman

“By investing at a discount, Benjamin Graham knew that he was unlikely to experience losses.”–Seth Klarman

“Because investing is as much an art as a science, investors need a margin of safety.”–Seth Klarman

“Margin of safety, by always buying at a significant discount to underlying business value and always giving preference to tangible assets over intangibles. By replacing current holdings as better bargains come along. By selling when the market value comes to reflect its underlying value and by holding cash, if necessary until other attractive investments become available.”–Seth Klarman

“Investors should pay attention not only to whether but also to why current holdings are undervalued. It is critical to know why you have made an investment and to sell when the reason for owning it no longer applies. Look for investments with catalysts that may assist directly in the realization of underlying value. Give preference to companies having good managements with a personal financial stake in the business.”–Seth Klarman

“Many of the forces that cause securities prices to depart from underlying value are temporary.”–Seth Klarman

“The hard part is discipline, patience and judgment.”–Seth Klarman

“Greater risk does not guarantee greater return. To the contrary, risk erodes return by causing loses. By itself risk does not create incremental return, only price can accomplish that.”–Seth Klarman

“Indeed, investors should expect prices to fluctuate and should not invest in securities if they cannot tolerate some volatility.”–Seth Klarman

“The trick of successful investors is to sell when they want to, not when they have to.”–Seth Klarman

“Many investors insist on affixing exact values to their investments, seeking precision in an imprecise world, but business value cannot be precisely determined.”–Seth Klarman

“The future is not predictable except within fairly wide boundaries.”–Seth Klarman

“The number of things that can go wrong, in business, greatly exceeds the number that can go right.”–Seth Klarman

“How do value investors deal with the analytical necessity to predict the unpredictable? The only answer is conservatism.”–Seth Klarman

“When a stock is selling at a discount to liquidation value per share, a near rock-bottom appraisal, it is frequently an attractive investment.”–Seth Klarman

“Net-net working capital is defined as net working capital minus all long term liabilities.”–Seth Klarman

“Since value investors attempt to buy securities trading at a considerable discount from the value of a business’s underlying assets, liquidation is one way for investors to realize profits.”–Seth Klarman

“Investors must remember that they need not swing at every pitch to do well over time, indeed selectivity undoubtedly improves an investor’s results. For every business that cannot be valued, there are many others that can. Investors who confine themselves to what they know, as difficult as that may be, have a considerable advantage over everyone else.”–Seth Klarman

“Upon occasion attractive opportunities are so numerous that the only limiting factor is the availability of funds to invest; typically the number of attractive opportunities is much more limited.”–Seth Klarman

“Value investment niches: 1) Shares selling at a discount to break up or liquidation value 2) Rate of return situations 3) Asset-conversion opportunities.”–Seth Klarman

“When a company eliminates its dividend, its shares often fall to unduly depressed levels.”–Seth Klarman

“When the reason for the undervaluation can be clearly identified, it becomes an even better investment because the outcome is more predictable.”–Seth Klarman

“Year-end tax selling also creates market inefficiencies. The internal revenue code makes it attractive for investors to realize capital losses before the end of each year. Selling driven by the calendar rather than by investment fundamentals frequently causes stocks that declined significantly during the year to decline still further. This generates opportunities for value investors.”–Seth Klarman

“Value investing is by its very nature is contrarian. Out of favor securities may be undervalued; popular securities almost never are.”–Seth Klarman

“Analyst’s recommendations may not produce good results. In part this is due to the pressure placed on these analysts to recommend frequently rather than wisely.”–Seth Klarman

“Yet high uncertainty is frequently accompanied by low prices. By the time the uncertainty is resolved, prices are likely to have risen.”–Seth Klarman

“It is often said on Wall St that there are many reasons why an insider might sell a stock (need for cash to pay taxes; expenses etc.), but there is only one reason for buying.”–Seth Klarman

“In fact, often there is not an immediate buying opportunity; today’s research may be advance preparation for tomorrow’s opportunities.”–Seth Klarman

“And investment program will not long succeed if high-quality research is not performed on a continuing basis.”–Seth Klarman

“Because other investors disparage [Have low opinion of] and avoid them, corporate liquidations may be particularly attractive opportunities for value investors.”–Seth Klarman

“As with any value investment, the greater the undervaluation, the great the margin of safety to investors.”-–Seth Klarman

“Not all complex securities are worthwhile investments. They may be overpriced or too difficult to evaluate. Nevertheless this area frequently is fertile ground for bargain hunting by value investors.”–Seth Klarman

“When the securities in a portfolio frequently turn into cash, the investor is constantly challenged to put that cash to work, seeking out the best values available.”–Seth Klarman

“My view is that an investor is better off knowing a lot about a few investments than knowing a little about each of a great many holdings. One’s very best ideas are likely to generate higher returns for a given level of risk than one’s hundredth or thousandth best idea.”–Seth Klarman

“Investment opportunity is a function of price, which is established in the marketplace.”–Seth Klarman

“A value investor does not get up in the morning knowing his or her buy and sell orders for the day; these will be determined in the context of the prevailing prices and an ongoing assessment of underlying values.”–Seth Klarman

“Since transacting at the right price is critical, trading is central to value-investment success. This does not mean that trading in and of itself is important; trading for its own sake is at best a distraction and at worst a costly digression from an intelligent and disciplined investment program.”–Seth Klarman

“The best opportunities arise when other investors act unwisely thereby creating rewards for those who act intelligently. When others are willing to overpay for a security, they allow value investors to sell at premium prices or sell short at overvalued levels. When others panic and sell at prices far below underlying business value, they create buying opportunities for value investors.”–Seth Klarman

“Spinoffs often present attractive opportunities for value investors.”–Seth Klarman

“A simple rule applies: if you don’t quickly comprehend what a company is doing, then management probably doesn’t either.”–Seth Klarman

“More significantly, they illustrate the way the herd mentality of investors can cause all companies in an out-of-favor industry, however disparate, to be tarred with the same brush.”–Seth Klarman

“Only a number of professional investors persisted in identifying this source of value-investment opportunities and understanding the reasons for its existence over a number of years.”–Seth Klarman

“Financially distressed and bankrupt securities are analytically complex and often illiquid.”–Seth Klarman

“Identifying attractive opportunities requires painstaking analysis; investors may evaluate dozens of situations to uncover a single worthwhile opportunity.”–Seth Klarman

“When properly implemented, troubled-company investing may entail less risk than traditional investing, yet offer significantly higher returns. When badly done, the results of investing in distressed and bankrupt securities can be disastrous; junior securities for example can be completely wiped out.”–Seth Klarman

“Many things can go wrong, with bankruptcy investments.”–Seth Klarman

“Since no investor is infallible and not investment is perfect, there is considerable merit in being able to change one’s mind.”–Seth Klarman

“Investors who are out of touch with the markets will find it difficult to be in touch with buying and selling opportunities regularly created by the markets.”–Seth Klarman

“Being in touch with the market does pose dangers, however. Investors can become obsessed for example with every market uptick and downtick and eventually succumb to short-term trading. There is a tendency to be swayed by recent market action, going with the herd rather than against it.”–Seth Klarman

“The most crucial factor in trading is developing the appropriate reaction to price fluctuations. Investors must learn to resist fear, the tendency to panic when prices are falling, and greed, the tendency to become overly enthusiastic when prices are rising. One half of trading involves learning to buy. In my view, investors should usually refrain from purchasing a ‘full position’ (the maximum dollar commitment they intend to make) in a given security all at once. Those who fail to heed this advice may be compelled to watch a subsequent price decline helplessly, with no buying power in reserve. Buying a partial position leaves reserves that permit investors to ‘average down’, lowering their average cost per share, if prices decline.”–Seth Klarman

“Evaluating your own willingness to average down can help you distinguish prospective investments from speculations. If the security you are considering is truly a good investment, not a speculation, you certainly want to own more at lower prices. If, prior to purchase you realize that you are unwilling to average down then you probably should not make the purchase in the first place.”–Seth Klarman

“Many investors are able to spot a bargain but have a harder time knowing when to sell. One reason is the difficulty of knowing precisely what an investment is worth. An investor buys with a range of value in mind at a price that provides a considerable margin of safety. As the market price appreciates, however, that safety margin decreases; the potential return diminishes, and the downside risk increases. Not knowing the exact value of the investment, it is understandable that an investor cannot be as confident in the sell decision as he or she was in the purchase decision.”–Seth Klarman

“Buying is easier, selling is harder. You can never know how big a bargain you will get tomorrow. So always keep a little in reserve. Buying a dollar for 50 cents could become 40 cents tomorrow.”–Seth Klarman

“Still others set sale price targets at the time of purchase, as if nothing that took place in the interim could influence the decision to sell. None of these rules makes good sense. Indeed there is only one valid rule for selling: all investments are for sale at the right price.”–Seth Klarman

“Decisions to sell, like decisions to buy, must be based upon underlying business value. Exactly when to sell or buy depends on the alternative opportunities that are available. Should you hold for a partial or complete value realization for example? It would be foolish to hold out for an extra fraction of a point of gain in a stock selling just below underlying value when the market offers many bargains. By contrast, you would not want to sell a stock at a gain, and pay taxes on it, if it were still significantly undervalued and if there were no better bargains available.”–Seth Klarman

“It is helpful to recognize that there are cycles of investment fashion.”–Seth Klarman

“The lessons of history keep repeating every day.”–Seth Klarman

“Investing is the intersection of economics and psychology.”–Seth Klarman

“Analysis is not that hard, but how much to buy, when to buy, knowing what to do, knowing when to sell when you have made a legitimate mistake is a harder thing and you can learn through experience when you have the right psychological makeup in the first place.”–Seth Klarman

“Don’t get into bed with bad people.”–Seth Klarman

“If you put clients first then they will do fine.”–Seth Klarman

“In contrast to the speculators preoccupation with rapid gain, value investors demonstrate their risk aversion by striving to avoid loss.”–Seth Klarman

“While it might seem that anyone can be a value investor, the essential characteristics of this type of investor – patience, discipline and risk aversion – may be genetically determined. Either you are able to remain disciplined and patient or you aren’t.”–Seth Klarman

“A value strategy is of little use to the impatient investor since it usually takes time to pay off.”–Seth Klarman