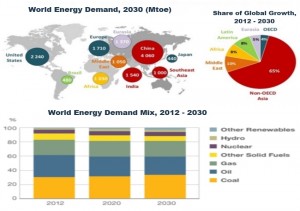

As emerging markets continue to grow and distribute wealth to their massive populations, the demand and prices for oil, commodities, gold, and energy will increase rapidly thus reducing supplies and increasing the cost of these scarce resources. Countries like China (and the Asia-Pacific region), India, Brazil, Latin America, and the rest of the emerging market countries with their growing populations and their increasing demand and desire to improve their wealth and status in the world, will result in lower supplies and an increase in prices and costs going forward for everyone.

The increase and decrease of oil, energy, and commodity prices are primarily a function of the forces of supply and demand. The world’s need for oil, energy, and commodities; which is fueled by the insatiable demand of developing and emerging economies, markets, and countries with massive populations, is starting to exceed our ability to produce it and live up to the demand. These conditions will be unavoidable.

The political tensions between the United States and the United Arab Emirates (OPEC), Iran, Iraq, Russia, Venezuela, and the rest of the Middle Eastern countries (the world’s largest oil exporters), unrest and war in Pakistan, Afghanistan, Iran, Nigeria, and North Korea, bad weather shutting down oil-exporting ports in the United States and Mexico, and the sagging dollar will continue to put pressure on oil and energy prices to move higher.

Since oil is priced internationally in dollars, it costs us and our trading partners more when the dollar weakens against other world currencies. Also, significant oil deposits of high demand light sweet crude are not being found as fast as existing deposits are being depleted. The above situations and trends will continue with little definitive improvements. The eras of the past with abundant and cheap oil, energy, and commodities are over.

As the world’s economies continue to recover, oil and energy demand and prices will move upward over time. Oil (i.e., WTI & Brent) prices will drop below $60 per barrel again in 2014. By the end of 2015, I expect oil to be between $60 to $70 per barrel. From here Oil and Energy stocks, ETFs, and mutual funds will continue over the long term to outperform the overall market. I expect a bull market for oil and energy investments over the next decade. Look for companies and countries that are aggressively building their oil, energy, and commodity reserves.