Currently, the outlook for bonds is clouded by a great deal of uncertainty. It is a difficult time for bond investors who are seeking bonds or bond funds that offer both safety and decent returns.

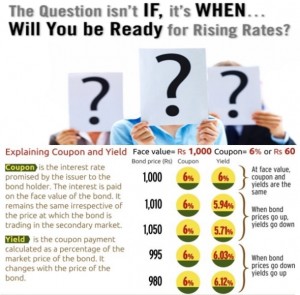

An imminent rise in interest rates can be bad news for bond investors, because rising interest rates can hurt the prices of existing bonds (i.e., interest rates increase, bond prices decrease). The last time the Federal Reserve increased short-term interest rates by 2 ½ %, bond and bond fund prices on average lost between 5% to 20% of their value.

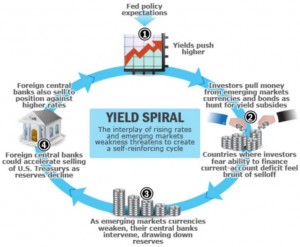

Even if the Fed does not raise short-term interest rates, intermediate and long-term rates will rise in the credit markets as a result of the following factors:

- The threat and anticipation of higher inflation from the weakening dollar and the excess printing of money will erode bond prices/values.

‘ - The threat and anticipation of continued weakness in the dollar from the lack of a credible and stable strong dollar/greenback policy will cause global investors to curtail purchases of Treasury bonds and other bonds/debt, thus driving up government’s, business’s, and individual’s cost of borrowing.

‘ - Excess government borrowing means corporate issuers will have to raise interest rates on their bonds to compete in the tighter and more competitive global marketplace.

As the economy shows clear signs of recovery, stock markets turn back up, and the threat of inflation increases, the Federal Reserve will have to raise its benchmark rates causing bond prices to go down as investors leave the safe haven of bonds to invest in stocks. All of the above factors are driving down returns and raising long-term risk for bond investors.

Nevertheless, this does not mean that you should get out of bonds altogether. Most investors need bonds for diversification and income. If you have an intermediate and long-term investment strategy and a well-diversified portfolio, bond returns in the near to long term will remain competitive with stocks for the foreseeable future. Even when stock markets rebound, bonds still offer solid returns as history has shown.

Therefore, reduce your bond portfolio’s risk by including bond types that are less sensitive to rising rates, higher inflation, a weakening dollar, and excess government borrowing:

- Short-term bonds are less likely to lose value if interest rates go up.

‘ - Foreign bonds will go up in value as the dollar weakens and do not correlate with U.S. interest rates.

‘ -

High-yield bonds react less to interest rate rises than to changes in credit quality.

‘ - Floating-rate senior notes are pooled and sold to investors by banks and corporations. They are a good hedge against rising interest rates, since their rates are reset every 30 to 90 days.

‘ - Seek intermediate-term investment-grade bonds selling at a discount from par with a higher quality rating of single-A or greater and a low duration.

‘ - Focus on reliable dividend growth and dividend yield, with income-oriented stocks that can sustain and increase payouts.

‘ - Own shares of companies that benefit from rising interest rates, specifically banks and insurers.

‘ - Look to engineering and construction companies specializing in natural gas infrastructure.

‘ - Buy European financials, industrials, health-care, telecom and consumer discretionary stocks, which will lead the euro-zone recovery.

‘ - Own “hard” assets including natural resources, along with Treasury Inflation Protected Securities (TIPS)

‘