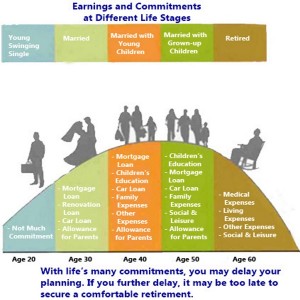

There is a simple rule of thumb to figure out how much to invest in stocks, subtract your age from 100–so a 45-year-old would put 55% (100 minus 45) in stocks. However, simple rules are only base guidelines and won’t help most investors meet their goals. Instead, decide what return you need to reach your goal and how much volatility and fluctuation you can bear. Then create an asset allocation that has consistently produced that return over long periods of time. The wealthier you are, the more conservative you can afford to be.

Under 30

Equity (Stocks, Funds) – 75%

Bond/Income (Bonds, Funds) – 5%

Other (REITs, Commodities) – 10%

Cash (Money Market and CDs) – 10%

30 to 39

Equity (Stocks, Funds) – 70%

Bond/Income (Bonds, Funds) – 10%

Other (REITs, Commodities) – 10%

Cash (Money Market and CDs) – 10%

40 to 49

Equity (Stocks, Funds) – 65%

Bond/Income (Bonds, Funds) – 15%

Other (REITs, Commodities) – 10%

Cash (Money Market and CDs) – 10%

50 to 59

Equity (Stocks, Funds) – 45%

Bond/Income (Bonds, Funds) – 35%

Other (REITs, Commodities) – 5%

Cash (Money Market and CDs) – 15%

60 and Up

Equity (Stocks, Funds) – 35%

Bond/Income (Bonds, Funds) – 40%

Other (REITs, Commodities) – 5%

Cash (Money Market and CDs) – 20%

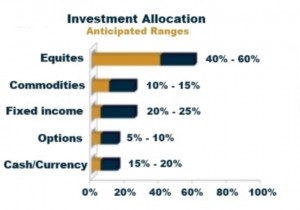

Portfolio Breakdown:

This area will be unique and designed specifically for each individual investor based on their investment goals, personality, character, investment knowledge, and risk tolerance. You should work with a registered investment adviser and manager to determine your investment goals, risk tolerance, and asset allocation strategy.

Equity (Stocks, Funds)

Mid Caps

Small Caps

International

Bond/Income (Bonds [ST, INT, LT], Funds)

Government

Inflation-Protected

Municipal

Corporate

High-Yield

Floating Rate Notes

Foreign

Other

REITs

Commodities

Cash

Money Market Accounts and CDs